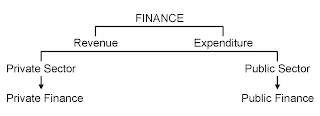

Meanings:

public finance is a branch of economics that deals with the expenses and revenues from government to government in the economy.

The long-term financing is revenue and expenditure. If you have a link to the private sector, private financing is needed. On the other hand, if it related to the public sector, ie, the public finances.

Private Finance:

Deal to income and expenditure by the private sector.

Public Finance:

This revenue and expenditure of the Government Sector (public sector)

Public finance Vs Private finance

1. Time period: The public finances in a period of several years together, while private financing to do with the financial daily, weekly, monthly, etc.

2. Assets Vs expenditure: In public finance, income from fees as follows. In addition, the cost of private financing in line with sales.

3. Arrears financing: Budget deficit, government. can create new tickets issued. In addition, the private sector has no authority to issue new tickets.

4. Nature of budget: In the public sector's budget deficit is important. In the private sector, the budget surplus is large.

5. Compulsory loans: The government can borrow to bind to other financial institutions to their cost, while the private sector can not be met.

6. Secrecy: State budget is not a secret, but Govt. published their budgets for television, radio, etc. On the other hand, the household, to keep the secret.

7. Nature of projects: In public finance, the government must complete the long-term projects. In addition, the private sector has a short project is completed.

8. Nature of changes: Public Finance shows significant changes, while the private sector has to do with minor modifications.

9. Accounting document: The state budget is a written document that the budget sector is a written document.

10. Analysis system: Govt. Revenue and expenditure is regularly monitored by an audit system. On the other hand, there is no system of private financing.

11. Adopted assistance: In the public finances, the Government may rely on foreign aid, but private financing, there is no way of outside help.

12. Absolute or aberrant antecedent of income: Public Finance, source of income is indirect, while the tax is a source of private funding, that address income.

13. Above-mentioned sanction: Public Finance, Government. have the prior approval of his cabinet, etc. National Assembly, Senate, while in private funding, without prior permission is required from any authority.

14. Future planning: In public finance, there are no long-term planning, while private funding is nothing planned.

15. Use of banking resources: In public finance, the main goal for the welfare of the population, used as in private funding, the resources for maximum personal satisfaction.

16. Almanac of finance: The private sector may or may not keep records of your finances, the govt. maintains a permanent record of your finances.

Conclusion:

We conclude that the financing of public and private sector for revenue and expenditure. In any case, we distinguish between public and private financing on the basis of certain criteria.