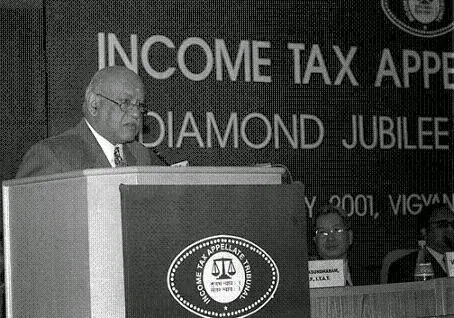

Appellate Tribunal :-

This tribunal is appointed by the federal govt. If taxpayer

or commissioner is not satisfied with decision of the commissioner appeals then

they can appeal to the above tribunal.

The details are given in income tax ordinance.

- Judicial Members :-

Judicial member is appointed by the federal govt. Who

fulfills the following conditions.

i). He has already worked as district judge and his

qualified to be a judge of High Court.

ii). He is or has been an advocate of high court and is

qualified to be a judge of High Court.

- Accountant Members :-

These are also appointed by the federal govt. They should

possess the following qualification.

i). He may be the income tax officer equal to the rank of

regional commissioner.

ii). He may be income tax commissioner who has at least two

years experience of appellate work.

iii). A person who has practiced as a charted accountant at

least 10 years or above.

- Chairman :-

Federal Govt. generally appoints the judicial member as a

chairman but accountant member is also eligible.

- Registrar :-

Registrar looks after the working of the offices of the

tribunal. He works under the chairman. He receives the appeals and fixes the

dates.

FUNCTIONS OF THE TRIBUNAL :-

To perform the functions the chairman may divides the

tribunal in to bunches. A bunch normally consists of two members. One from each

side. The federal may allow any one member to hear and decide any case.

Majority decisions are accepted in case of any difference on

any point. In the disputed cases chairman appoints one or more members of the

tribunal to hear the case.

FINAL DECISION :-

On the point of facts the decision of tribunal is considered

final. On the other hand if the decision of the tribunal involves a point of

law the case can be referred to the high court.

0 Comments