We discuss about difference or distinction points between Share and Debenture under these headings:-

We discuss about difference or distinction points between Share and Debenture under these headings:-1. Representation:-

Share: Share represent a share in the share capital of the company.

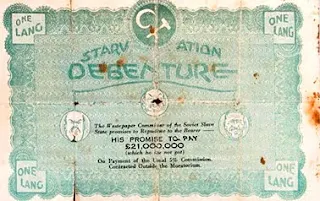

Debenture: IT represent the acknowledgment of debts of the company.

2. Position:-

Share: Share holders are the owner of the company.

Debenture: Actually they are not owners but are considered as creditors of the company.

3. Participation:-

Share: They have right to participate in management of the company thought Board of Directors.

Debenture: They cannot conduct the management of the company neither directly not indirectly.

4. Investment Return:-

Share: Share holders have got right to participate in the profit of the company at the specific or variable rate.

Debenture: Debentures holder have got right to enjoy interest at the fixed rate.

5. Withdrawal Rights:-

Share: The shareholders cannot withdraw their share capital unless the company goes into liquidation or decides to reduce its share capital

Debenture: The amount of the debentures is returnable after the expiry of the specific period.

6. Justification:-

Share: The process of distribution of point or loss among the share holders may be justified in Islam.

Debenture: As debenture holder have to receive interest in every case irrespective of the profit or loss it cannot be justified in Islam.

7. Records Position:-

Share: The rights and powers of the share holders are laid down in Article of Association.

Debenture: The rights and powers of the debenture holder are mentioned in the certificate issued at the time of accepting loan.

8. At the time of Liquidation:-

Share: Share holders have got second right in regard to repayment of capital if there is any balance at time of winding up of the company.

Debenture: In case of liquidation debenture holder have first right to get back their amount from the company.

9. Nature of Securities:-

Share: As the shares are not issued against the charge of any property of company so the are considered in secured.

Debenture: As the assets of the company may be charged against the loans, so debentures are regarded secured security.

0 Comments