Accelerator :-

The concept of accelerator was introduced by Clark. It shows the opposite effect of multiplier. According to it when income increases it leads to increase in investment.

Example :- When the income of any community rises, the purchasing power of the people increases. They being to buy more goods. The demand for consumption increases. The rise in investment is greater than the rise in demand of consumption goods. So investment is a function of income.

I = F (Y)

Accelerator principle explains the concept that a rise in national income, increases the total demand and expenditure. It leads to investment. The rise in investment will be greater than the rise in income. On the other hand if there is a fall in income, investment will decrease more than the income. There can also be negative effect of accelerator. We can explain it by the following example.

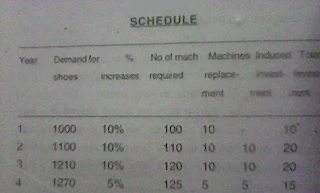

Example :- Let us suppose that there are 100 machines producing 1000 shoes in the country, and average life of the machine is 10 year. It means that every year 10 machines will be reduced to replace the old ten machines. Further we assume that demand for shoes increase by 10%. To meet the new demand, there will be a need of 10 more machines. Now capital industry will produce 20 machines instead ( 0f 10 machines). So we find that 10% increase in consumption goods will increase 100% increase in the production of capital goods. There will also be 100% increase in employment.

Explanation :

1. When there is 10% increase in consumption there is 100% increase in induced investment.

2. If the rate of increase in consumption remains constant the induced investment is zero.

3. If the rate of rise in consumption decreases the induced investment will fall.

ASSUMPTION

1. Constant Ratio :-

It is assumed that the ratio between capital and out put remains constant.

2. Working in Full Capacity :-

It has been assumed that machines are working in full capacity, so further production can not increase.

3. Continuous Increase in Demand :-

It has been assumed that demand of consumption goods increases constantly.

4. Capital Goods Industries :-

It has been assumed that capital goods industries are not working in full capacity. With the increase in demand the capital goods can be produced by the machine working industry.

5. Full Employment :-

There is a full employment in all the industries of consumption goods.

CRITICISM

1. Capital Out put Ratio :-

In this theory it has been assumed that capital out put ratio remains constant but it is not correct.

2. Machines Replacement :-

Accelerator is applied on new investment and not on replacement investment.

3. Temporary Demand :-

It is also criticized that temporary increases in demand of consumption goods will not increase the investment.

4. Investment which Lowers the Cost :-

In this theory, that investment is not considered which lowers the cost of production.

5. Financial Condition of the Firm Ignored :-

According to this theory with the rise in the demand of consumption goods, a firm increases the investment. If the financial condition is not sound then it will not be possible for that.

0 Comments